By Henry Uche, Lagos

The Chartered Institute of Taxation of Nigeria (CITN) has inaugurated its United Kingdom and District Society last Saturday.

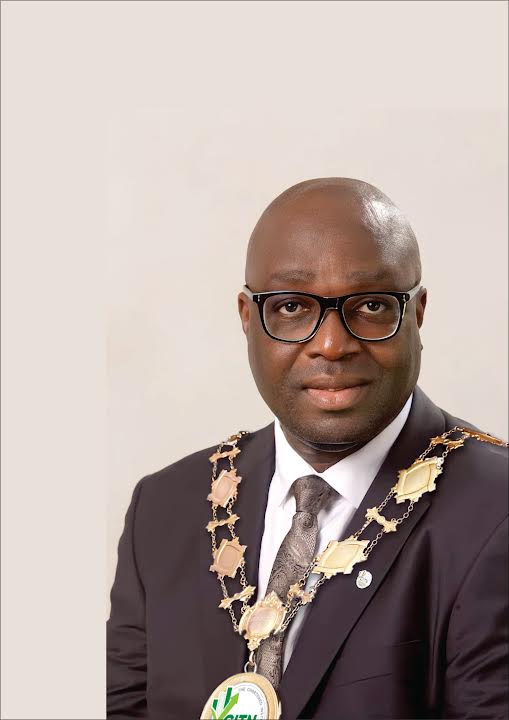

Delivering a keynote address, the 16TH President of the Institute, Mr. Samuel Agbeluyi, at the investiture ceremony of its Pioneer Chairman, Chief Peter Olu Boladale Makinde, said the establishment of the United Kingdom and District Society not only signifies institutional growth but also embodies the spirit of resilience, dedication and vision.

CITN President who applauded the unwavering commitment of all members of the District in making sure the UK District becomes a reality, alarmed the Pioneer chairman (who would pilot the affairs of the Society for the next two years), that his investiture is a call to service and without prejudice to the challenges that may emerge, he must live up to responsibilities and show accountable in his leadership.

“The concept of District Societies has served as the connecting link bridging the gap between the Central Body and its numerous members across various states in Nigeria. Just like the proverbial mustard seed, this initiative that began about two decades ago has grown and spread to about 34 States in Nigeria and the FCT. Moreover the number of District Societies has expanded tremendously to an impressive 44 districts.

“What is even more remarkable is that we have today transcended borders and established our presence in the United Kingdom demonstrating that our professional expertise knows no boundaries”

Agbeluyi reminded members of the Institute that inauguration of UK District holds immense benefits for both Nigeria and the United Kingdom. He urged the District Society pioneer Chairman to focus on knowledge sharing on the potentials of the OECD Beneficial Ownership Initiative and the Common Reporting Standard which gave rise to automatic exchange of information between tax administrations, as part of his core mandate.

“I expect the District to create awareness and advocate for the effective implementation of bilateral treaties between the UK and Nigeria, particularly, Double Taxation Agreements. This District Society holds a key to unlocking the benefits and expectations of these frameworks for businesses and tax authorities operating in both jurisdictions”

The Tax expert who acknowledged that the task ahead is enormous expressed confidence in the ability of Mr MaKinde to perform exceedingly beyond expectations, urging him to work assiduously and selflessly to make the District a point of reference among other district societies in the shortest possible time.

“Members will be looking up to you for responsive leadership and I am confident you won’t let them down. For emphasis, let me reiterate that the concept behind District Societies is to provide a formal platform for members to collectively organise and make impact at the sub-national and international levels.

“Council of the Institute will be assessing the performance of the UK and District Society by evaluating its impact in areas of Projecting the image of CITN and upholding its Charter, Effective contributions to issues affecting tax and fiscal policy in Nigeria, your ability to liaise effectively with stakeholders within the tax and fiscal policy landscape of the United Kingdom; ability to provide a strong platform for capacity development of members of this District; attending to welfare of members; and ensuring adequate publicity of the District’s activities.

“I assure you that Council will support you towards achieving your stated aims and objectives, such that in a short while, the effect of your activities will be acknowledged not only in the UK but internationally” he affirmed.